Rupee one of the worst performers among its Asian peers in the past 1 year

By Administrator_India

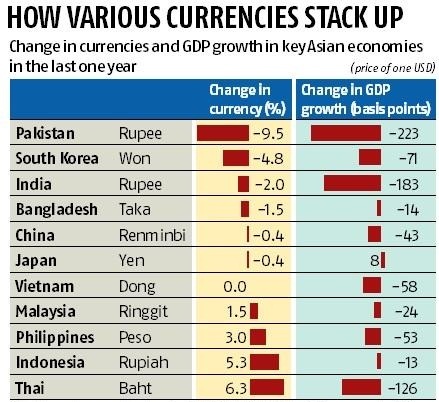

A sharp deceleration in economic growth and surge in inflation have begun to weigh on the rupee exchange rate. The Indian rupee has become one of the worst performers among its Asian peers in the past one year, with the exception of the South Korean won and the Pakistani rupee.

The Indian rupee is down nearly 2 per cent against the US dollar since the beginning of January 2019, against 6.3 per cent appreciation in the Thai baht, 1.5 per cent appreciation in the Malaysian ringgit, and 3 per cent gains logged by the Philippines peso against the US dollar in the period.

The Chinese renminbi is down 0.4 per cent against the dollar in the past one year

Experts attribute the Indian rupee’s relatively poor performance to a sharper-than-expected fall in economic growth in India.

“There is strong correlation between the strength of a currency and economic growth in the issuing country. India has seen one the biggest falls in growth of gross domestic product among its peers, leading to downward pressure on the currency,” says G Chokkalingam, founder and managing director, Equinomics Research & Advisory Services.

Capital inflows into India improved after the cut in corporate tax in September last year, which subsequently led to a rally in stock prices.

India’s economy is expected to grow by 5 per cent in FY19-20 at constant prices, down 183 bips from 6.8 per cent growth a year ago. This is one of the sharpest declines in economic growth in any major emerging economy, according to the latest World Economic Outlook database by the International Monetary Fund (IMF).

The depreciation in the Indian rupee in 2019 came on the back of an 8 per cent depreciation in CY18. With this, the rupee has lost value in four of the last five calendar years and eight of the last 10 calendar years.